Project Overview

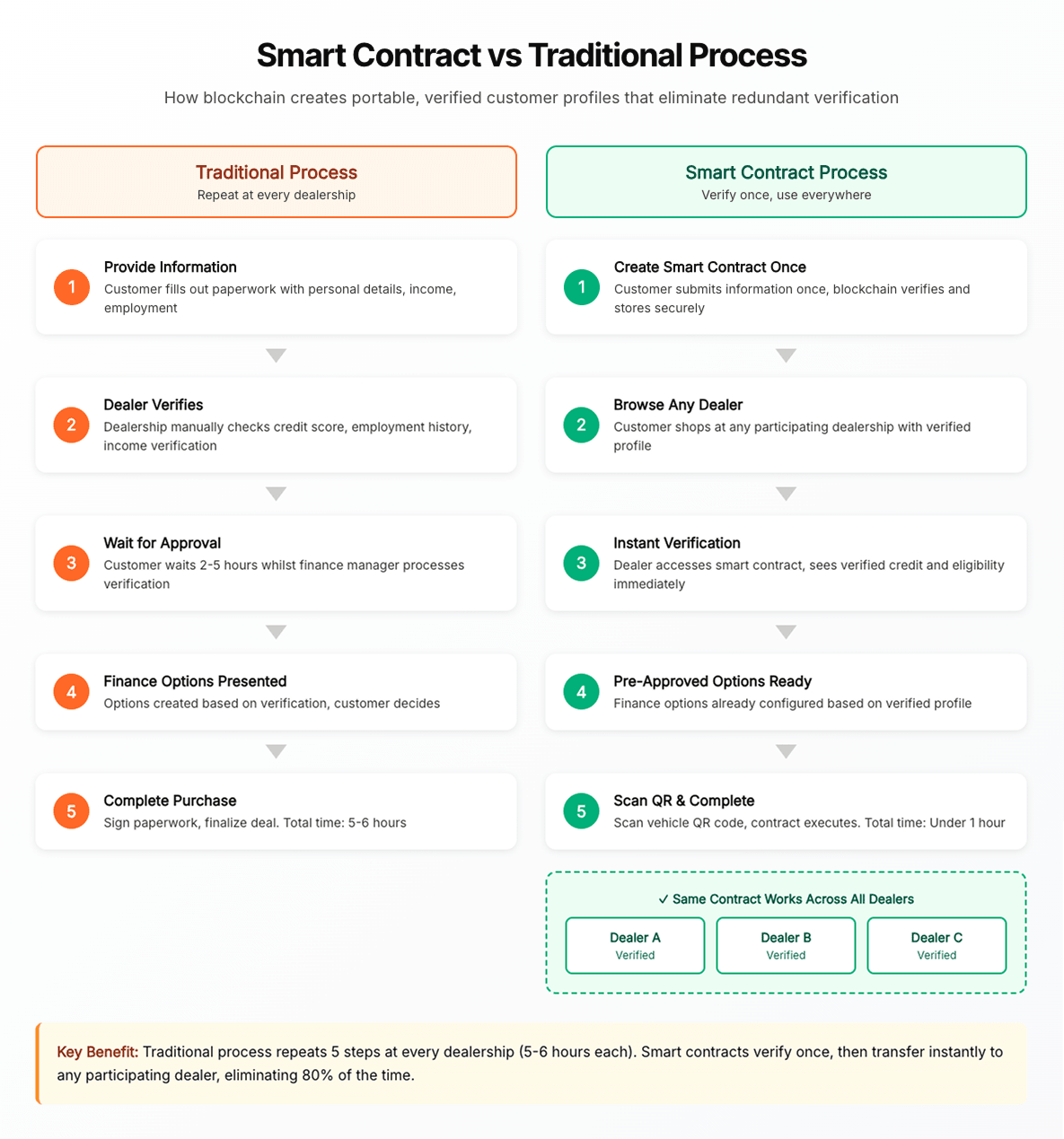

AutoBase reduces car purchase time by 80% (from 5-6 hours to under 1 hour) by solving a fundamental coordination problem: three parties (customer, dealer, finance manager) must verify the same information repeatedly because of Risk Management processes and KYC (Know Your Customer) requirements. Created during FIS Global’s Innovate in 48 hackathon, the system uses blockchain-based smart contracts to create a portable, verified customer profile that customers can share across any dealership without re-entering data.

We explored three approaches:

- a traditional database system (fast to build but doesn’t solve trust)

- a hybrid system (reduces some paperwork but still requires verification)

- blockchain smart contracts (higher technical complexity but eliminates redundant verification entirely). We chose blockchain because the trust problem was fundamental, not just an efficiency issue.

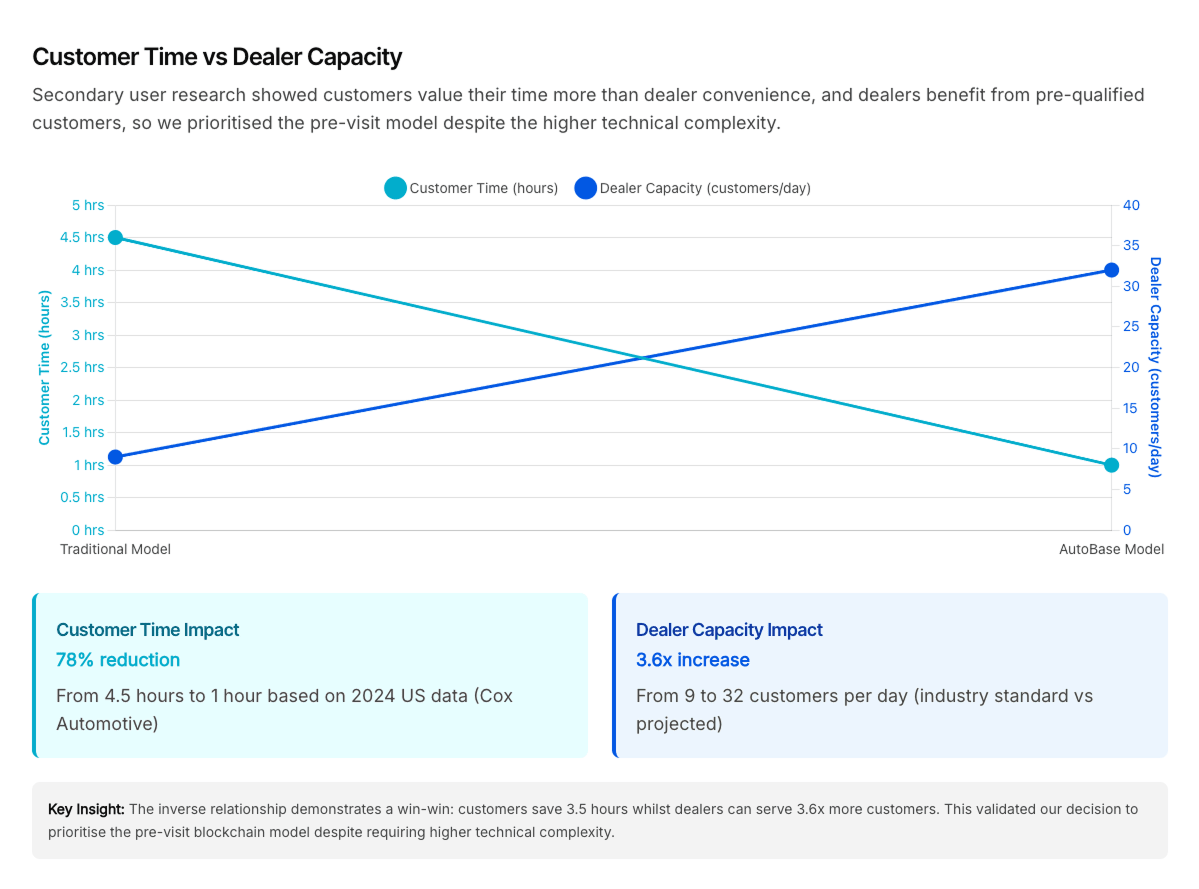

We considered two timing models:

- optimising the in-dealership finance process (reduces time from 5 hours to 3) versus

- moving verification before the dealership visit (reduces to under 1 hour).

Secondary user research showed customers value their time more than dealer convenience, and dealers benefit from pre-qualified customers, so we prioritised the pre-visit model despite the higher technical complexity.

My Role: Senior Product Designer and Front-end Web Developer

Timeline: 48 hour hackathon

Team: 1 Designer, 1 Product Manager, 3 Developers

Product Type: B2C car buying app with B2B back end for dealers with one or more dealerships.

Problem

Buying a car wastes billions of hours annually because customers re-enter the same information at every dealership (45-60 minutes per location), and finance managers spend 60-70% of their time re-verifying data that’s already been verified elsewhere.

When customers visit multiple dealerships (average 3-4 locations), they complete identical paperwork each time, then wait 2-5 hours for finance approval as documents move between sales and finance teams.

The root cause is a trust problem: independent dealerships don’t trust each other’s verification, so every location must verify from scratch. This creates an impossible choice: either trust unverified data (risky) or waste time re-verifying everything (inefficient). The result: customers abandon purchases due to exhaustion, dealers lose sales, and finance managers focus on paperwork instead of creating financing solutions.

With 75 million cars sold annually worldwide, this inefficiency compounds into a massive systemic problem. Secondary research through online user stories, consumer complaint forums, and automotive industry reports revealed that younger buyers (25-35) who expect digital-first experiences are particularly frustrated by this analogue, repetitive process.

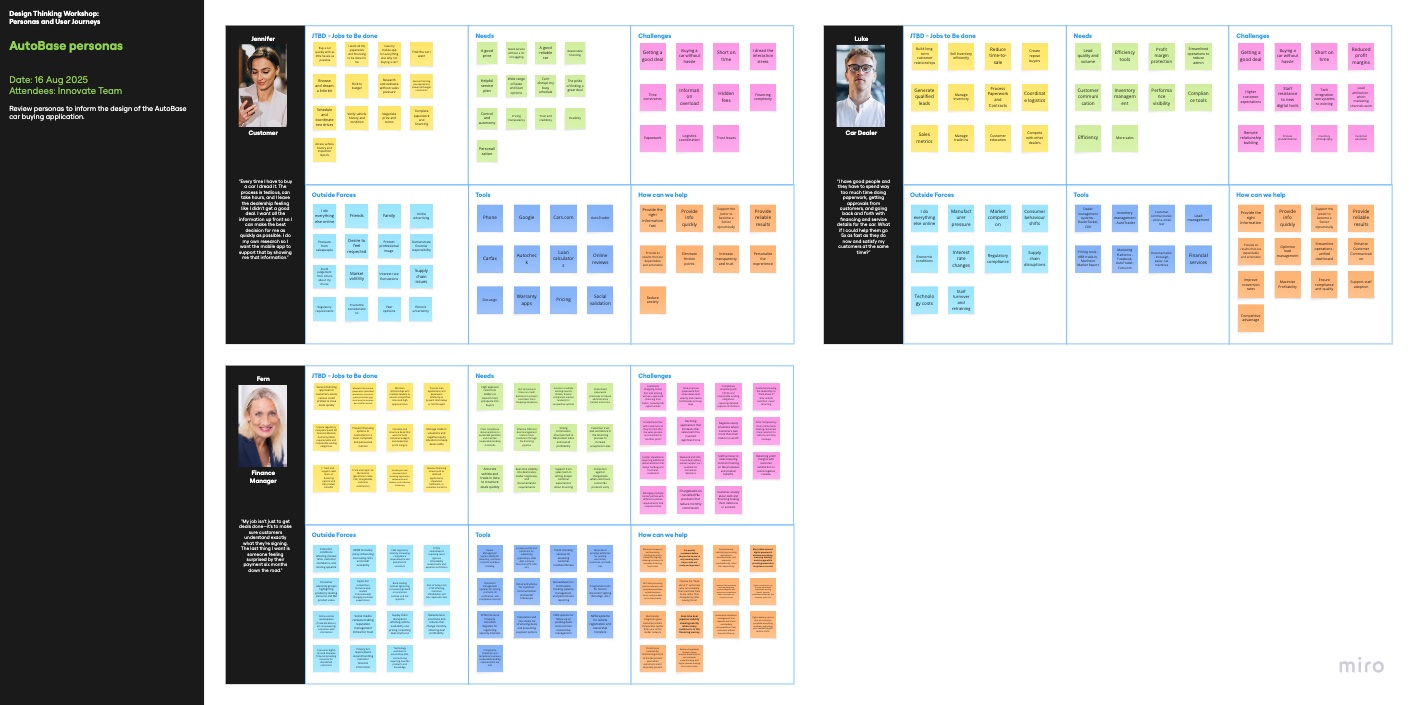

Personas

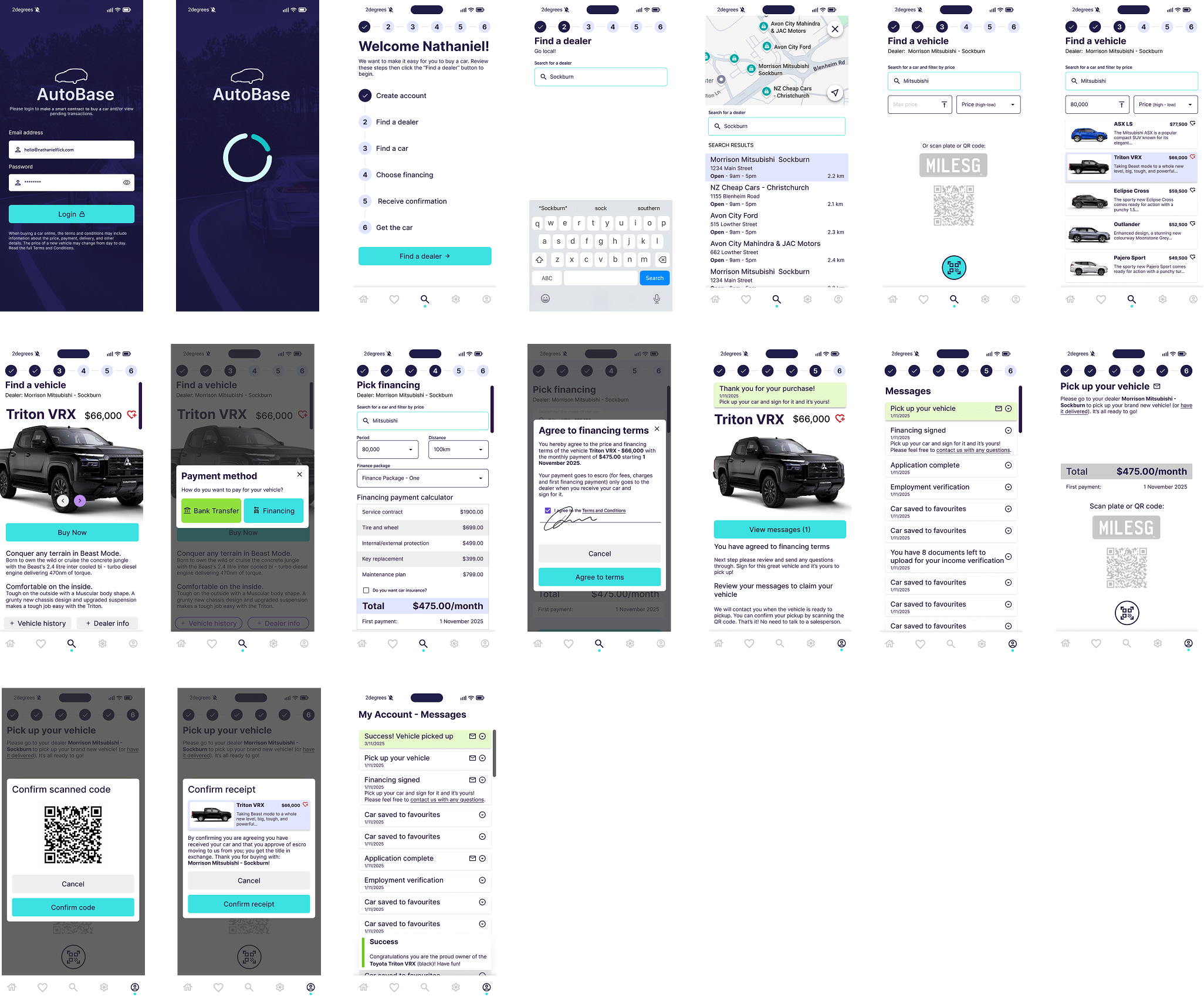

We designed for three distinct user types with different needs and technical literacy levels. Customers (25-35 years old, digital-first expectations) want to browse vehicles remotely, get pre-approved for financing, and minimise time spent on administrative tasks at the dealership. They research online for 2-3 weeks, visit 3-4 dealerships, and resent repeating the same verification process at each location.

Finance Managers need to verify customer identity and creditworthiness to assess risk and structure financing options, but they spend most of their time on redundant verification rather than creating value through personalised financing solutions. They need to trust customer data without re-verifying everything, but current systems don’t provide this assurance across independent dealerships.

Car Dealers need to close more deals faster to increase revenue, but the lengthy verification process exhausts customers and limits how many transactions can be completed daily. They need visibility across all dealership locations to identify where deals are stalling and intervene to keep transactions moving towards completion.

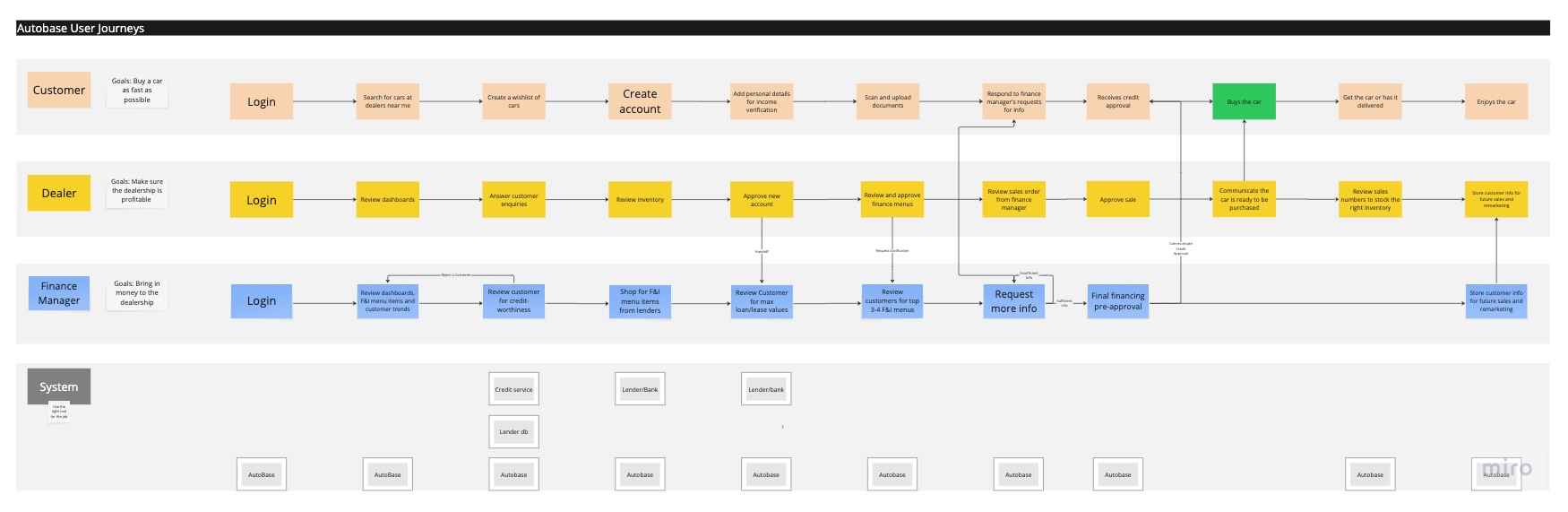

User Journeys

The traditional car buying journey creates friction at every step. Customers research vehicles online, visit multiple dealerships to compare options, fill out identical paperwork at each location (identity verification, credit application, income proof), then wait hours for finance approval whilst paperwork circulates between sales and finance teams. This process repeats at every dealership, wasting 45-60 minutes on data entry plus 2-5 hours waiting for each location visited.

AutoBase transforms this journey by moving verification before the dealership visit. Customers complete identity and credit verification once through the mobile app, receive a blockchain smart contract with their verified profile, then browse available inventory filtered to their approved budget. When they find a vehicle they want, they visit the dealership, scan a QR code to share their verified smart contract, and the finance manager immediately structures 3-4 personalised financing options without re-verifying anything.

The finance manager’s journey shifts from reactive verification to proactive deal structuring. Instead of spending hours verifying each customer’s information, they scan the blockchain smart contract, instantly trust the cryptographically verified data, and focus their time on creating compelling financing packages. Car dealers gain real-time visibility into deal status across all locations, identifying bottlenecks and reallocating resources to close more deals faster.

Constraints

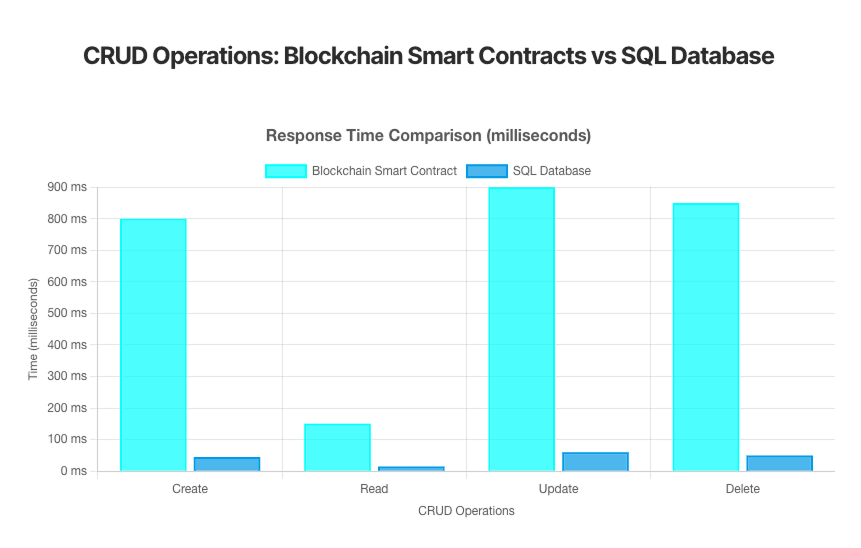

The hackathon required blockchain-based solutions, which became both a constraint and our core innovation. Blockchain is slower than traditional databases for CRUD operations, but it solves the trust problem that databases can’t address. Independent dealerships will trust cryptographic proof even when they won’t trust each other’s verification. We had to prove blockchain’s trust benefits outweighed its speed limitations.

The 48-hour timeline forced ruthless prioritisation. We needed a functioning prototype, not smoke and mirrors, which meant designing three complete user interfaces (customer mobile app, dealer dashboard, finance manager tools) whilst learning Microsoft’s Smart Contract protocol simultaneously. The team was limited to 5 people with no external help except our mentor, and we had no access to primary user research. All insights came from secondary sources.

Multi-user complexity created design challenges. Three user types with different technical literacy levels needed different information depth: customers wanted simplicity, finance managers needed detailed credit data, and car dealers required deal status across locations. One system had to serve all three without overwhelming the less technical users or limiting the power users.

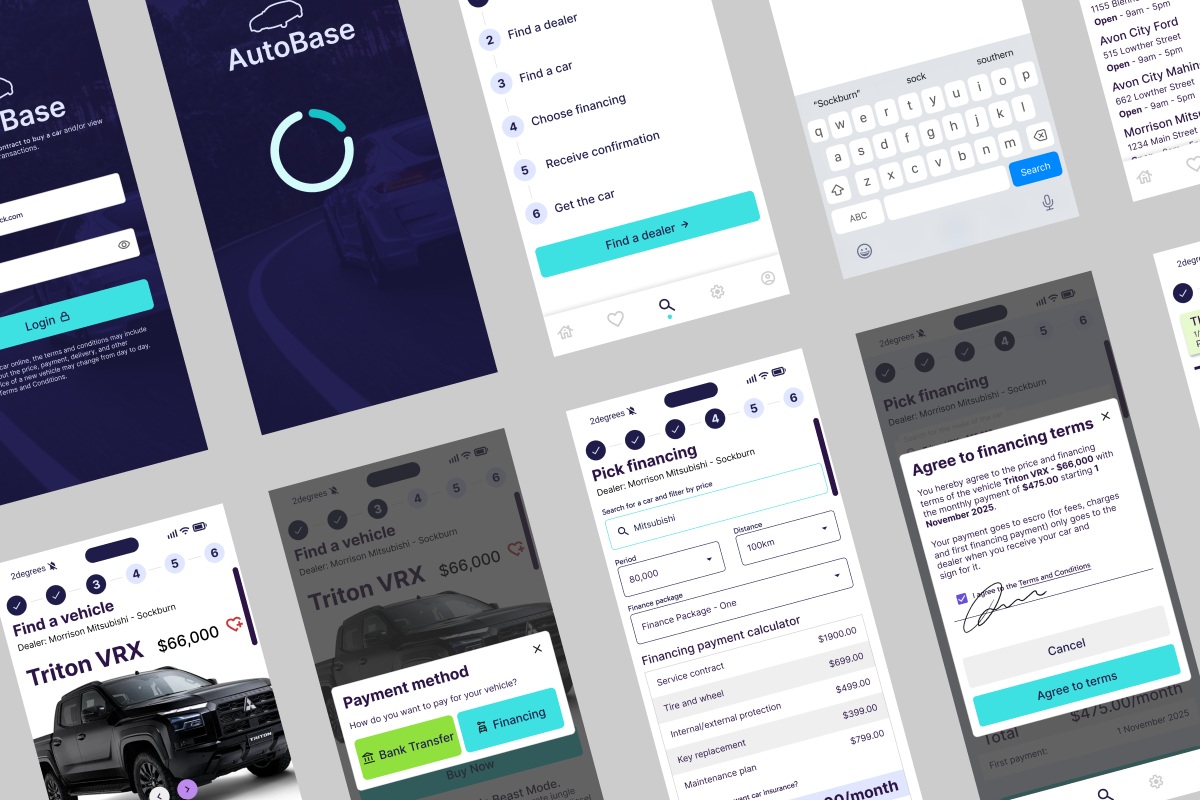

Solution

We designed a blockchain-based smart contract system that creates portable, verified customer profiles. Customers complete verification once (identity documents, credit check, income verification), and a finance manager reviews and approves the information, creating a cryptographically signed smart contract. The customer owns this contract and can share it at any dealership via QR code, eliminating redundant data entry and re-verification.

The solution required platform-specific interfaces optimised for each user’s context. Customers use a mobile app to browse inventory (filtered to their approved budget), complete verification remotely, and scan QR codes at dealerships to share their smart contract. Dealers and finance managers use web-based dashboards with desktop power tools for managing inventory, processing approvals, and viewing deal status across all locations.

We applied progressive disclosure by tailoring complexity to each user’s role. Customers see only vehicles within their budget and simple monthly payment options. Finance managers see full credit profiles, risk assessments, and can configure 3-4 financing packages. Car dealers see deal status across locations with visibility into which transactions are stalling. This role-based approach shows each user only what they need to make decisions, reducing cognitive load whilst maintaining necessary detail for power users.

Learnings

One thing we could have done better: Explaining why blockchain mattered beyond technical implementation. Judges questioned where contracts would be stored and whether they’d be secure, which showed we hadn’t made the value clear. We should have led with the problem blockchain solves: customers currently re-enter the same information at every dealership, and each dealer re-verifies everything because they don’t trust previous assessments. Blockchain creates portable, verified records that travel with customers, eliminating redundant verification through cryptographic proof rather than institutional trust.

The 48-hour constraint forced us to design all three interfaces at medium fidelity rather than perfecting one. This decision was correct because judges needed to see the full ecosystem to understand how blockchain coordinated between users. However, we could have communicated the coordination value more clearly in our presentation. The technical implementation impressed engineering judges, but less technical judges didn’t immediately grasp why blockchain was essential versus a traditional database.

Working without primary user research meant making informed assumptions about user needs based on secondary sources. Whilst our assumptions proved reasonable (judges confirmed the pain points resonated), having even brief interviews with car buyers and dealership staff would have strengthened our understanding of edge cases and validation priorities. The hackathon format didn’t allow time for research, but future iterations would benefit from validating assumptions with actual users before committing to technical architecture.