Outcomes

- Project: Autobase (company-wide Innovate in 48 competition at FIS Global)

- Placing: 4th Place worldwide (50 teams)

- Product type: Consumer

- Service improvement: 80% time reduction (5 hours down to 1 hour)

- Team size: 5

- Tech: Dotnet, MSFT Smart Contract Protocol (Blockchain), HTML5, CSS3, JavaScript, jQuery, Foundation 6

Video Prototype

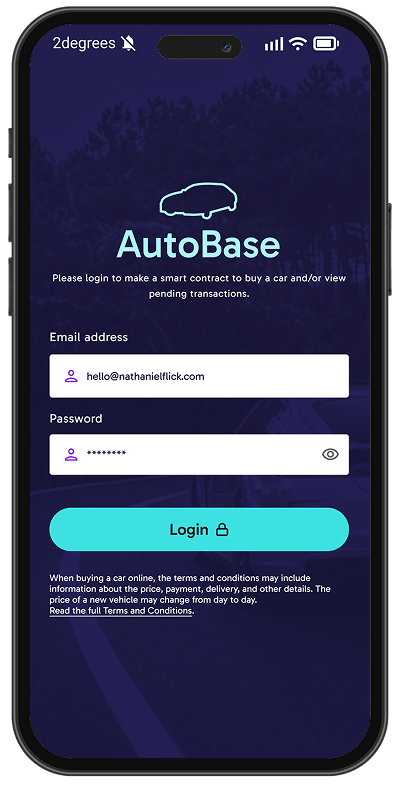

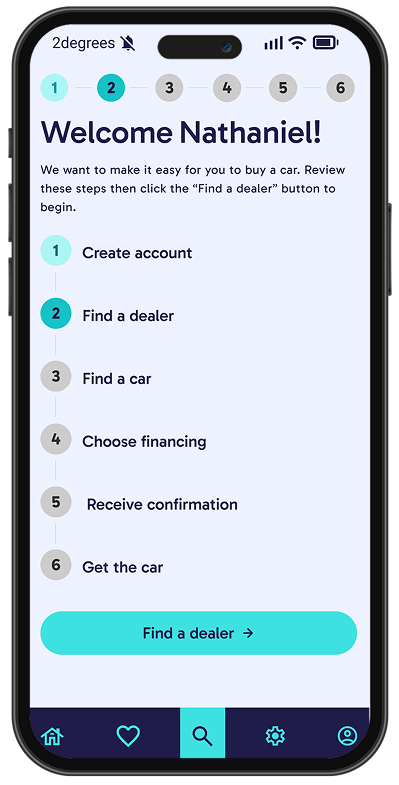

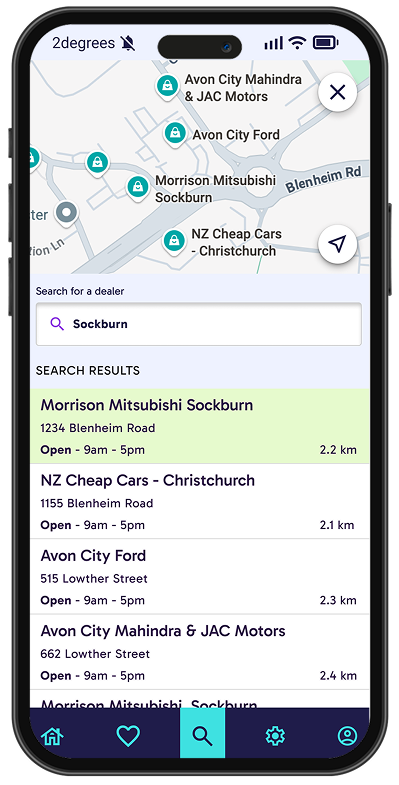

Figma Prototype

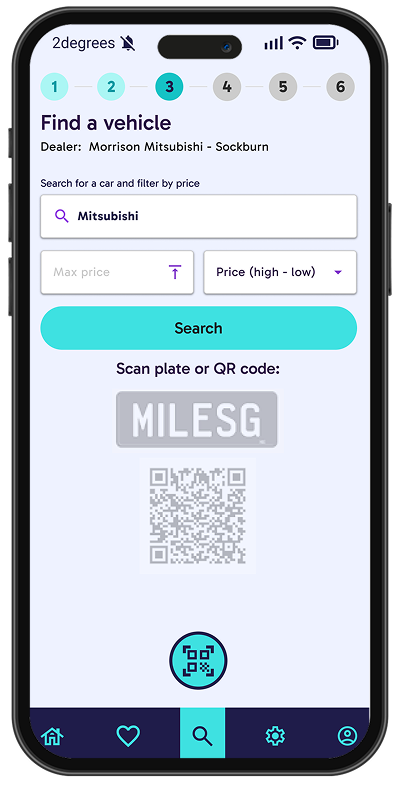

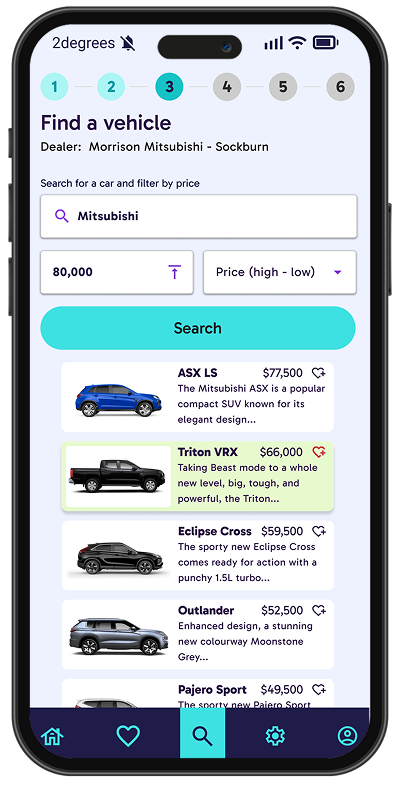

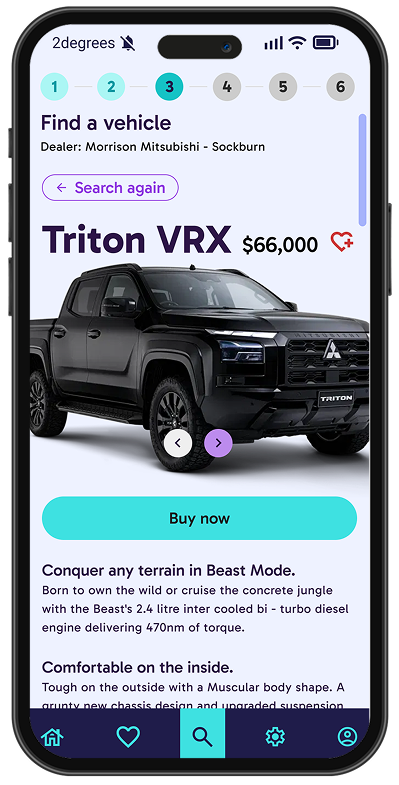

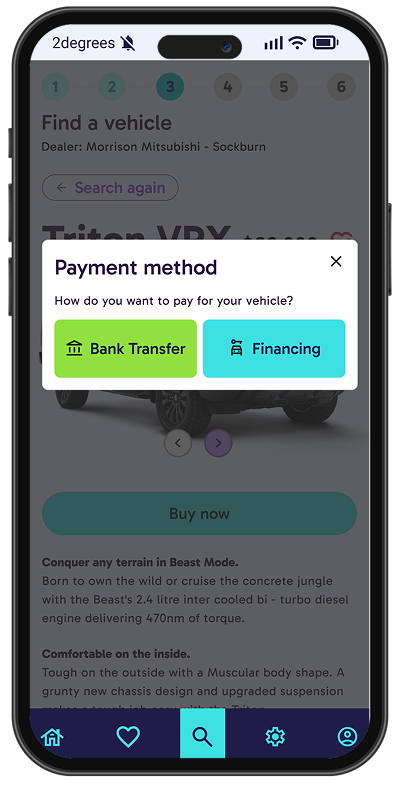

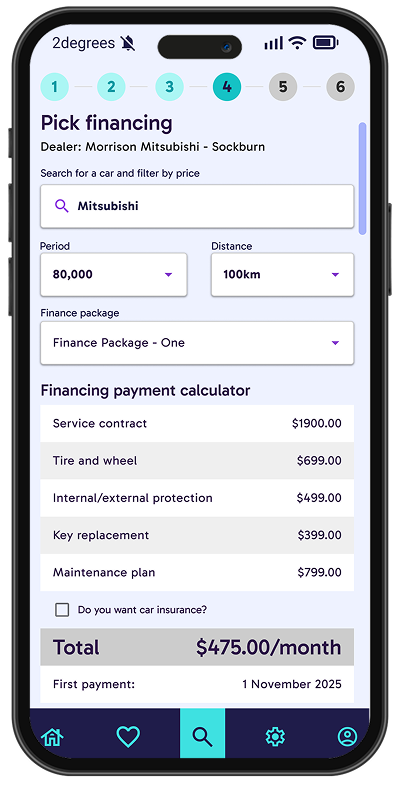

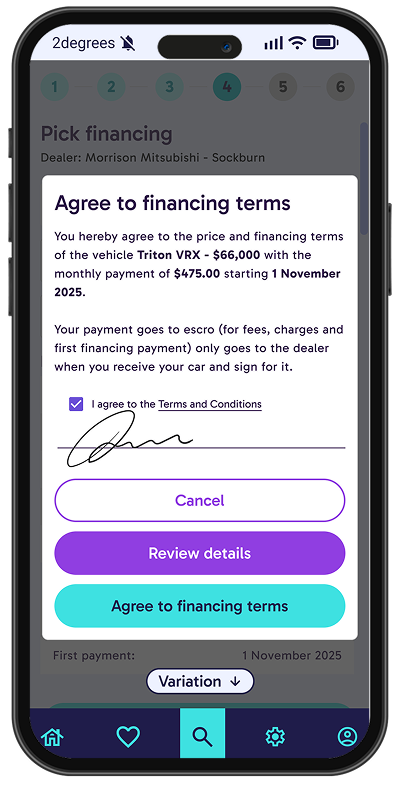

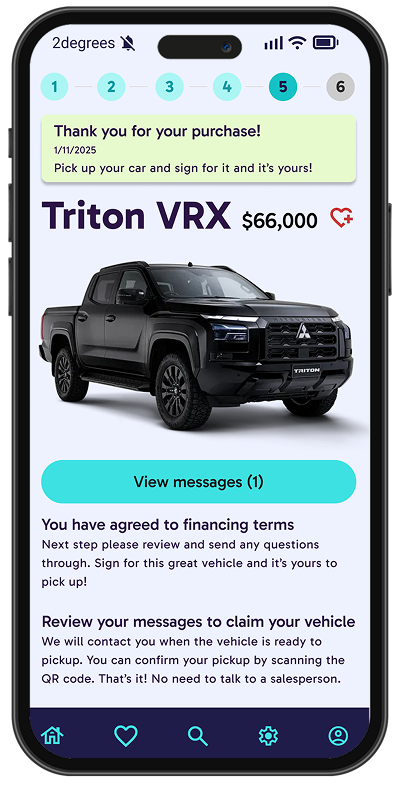

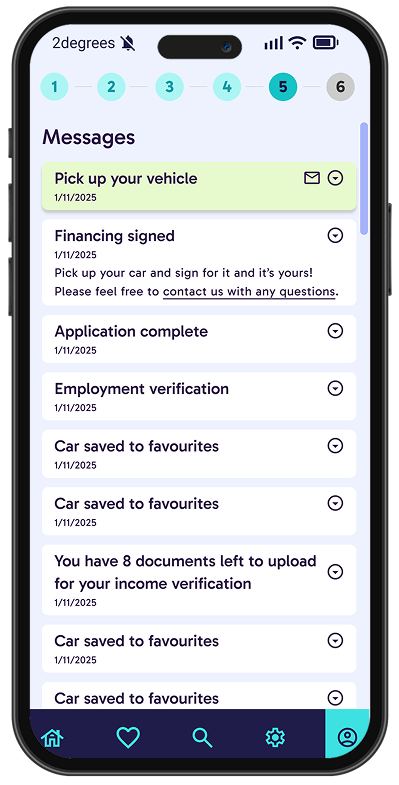

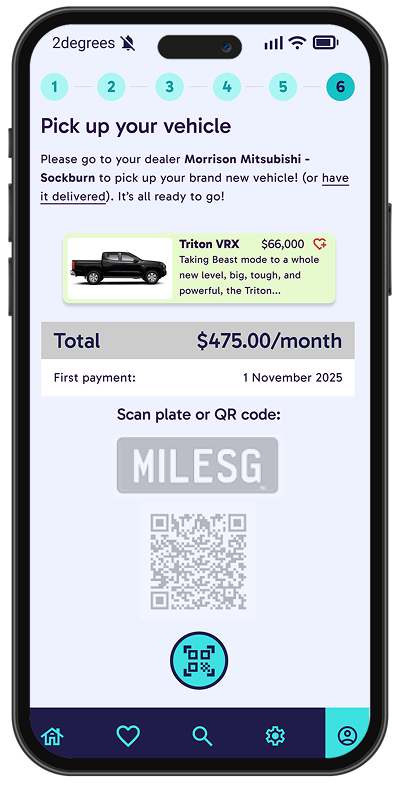

This is the prototype of the Customer user journey. Click the play button to play the carousel, or use the arrow keys to go back and forth between screens. On a mobile device you can swipe left and right.

Brief

It takes too long to buy a car! The modern customer is used to buying items on demand, one-click purchases with no hassles.

AutoBase revolutionizes car buying by reducing transaction time from 5 hours to 1 hour through blockchain-powered smart contracts. Customers sign up once and their verified information is securely stored, eliminating repetitive paperwork for future purchases by simply scanning a QR code to complete the sale.

This 4th-place global innovation entry combines mobile-first UX design with blockchain technology to create a seamless, paperless experience for customers, dealers, and finance managers.

Once the customer has filled out the finance paperwork, it is loaded to a blockchain contact they can use in future transactions. No more paperwork!

In 2023, 75 million cars were sold worldwide.

- When you go to buy a car, you can expect to spend 5 to 6 hours at the dealership and to fill in multiple paper documents.

- With the new AutoBase product the time to settlement will be reduced to 1 hour

- All documentation will be electronically captured in a smart contract enabling increased sales volumes and eliminating paperwork.

The Team

For the mobile app I’m the UX Designer and Web Developer, and I guide my 5-person team through Design Thinking sessions to brainstorm the idea, personas, and tech approach. I’m responsible for part of the demo presentation we used to compete in our company’s 48-hour hackathon. Our team of five consists of three developers, a project manager and me.

Scope and Constraints – 48 Hours

The constraints were the 48 hours for the competition and to use the tech we had available. So we used a basic HTML/CSS front end with some jQuery and JavaScript with a dotnet back end and the Microsoft Smart Contract protocol. Budget wasn’t a factor except for our use of the Smart Contract engine in Azure provided by Microsoft.

My Process and Role

As a UX Designer my process is Design Thinking and my role is to keep the team on track, focused on our user personas.

First we brainstormed the idea, getting all of our ideas into sticky notes in Balsamiq. Then we created a storyboard for the user journey.

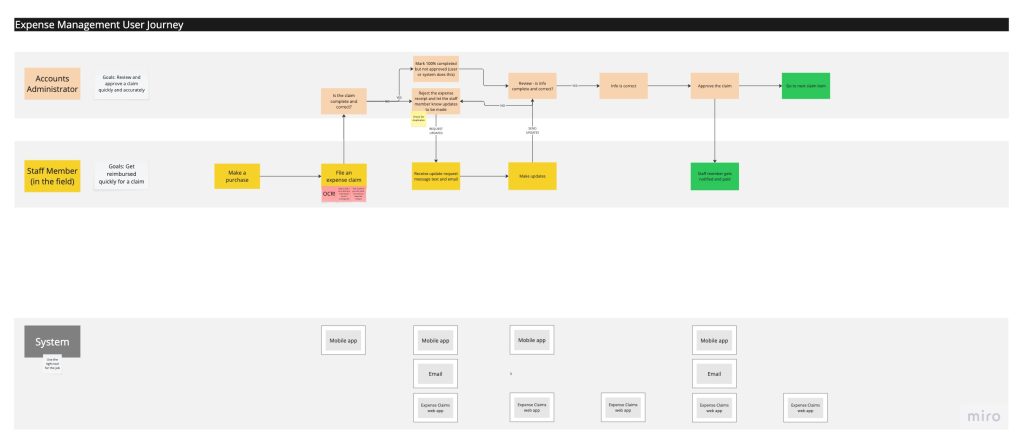

Start with a user journey map

Once we decided on our personas we got started with the storyboards. This is how we determined the steps and roles each user would take in the transaction. The user journeys on a workflow map.

Personas

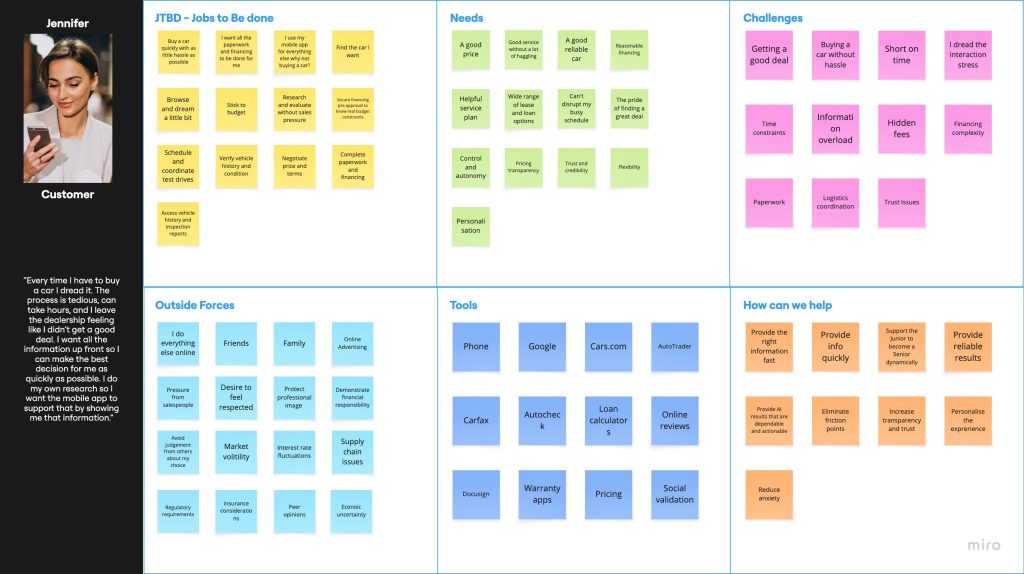

Jennifer, the Customer

“Every time I have to buy a car I dread it. The process is tedious, can take hours, and I leave the dealership feeling like I didn’t get a good deal. I want all the information up front so I can make the best decision for me as quickly as possible. I do my own research so I want the mobile app to support that by showing me that information.”

– Jennifer (Customer persona)

First, Jennifer. She wants to use her mobile app to browse cars via price, make and model, then answer a few short questions on the way to getting financing and then buying her car. Then she goes to pick it up and scans the QR code on the car to complete the transaction, all on blockchain contracts.

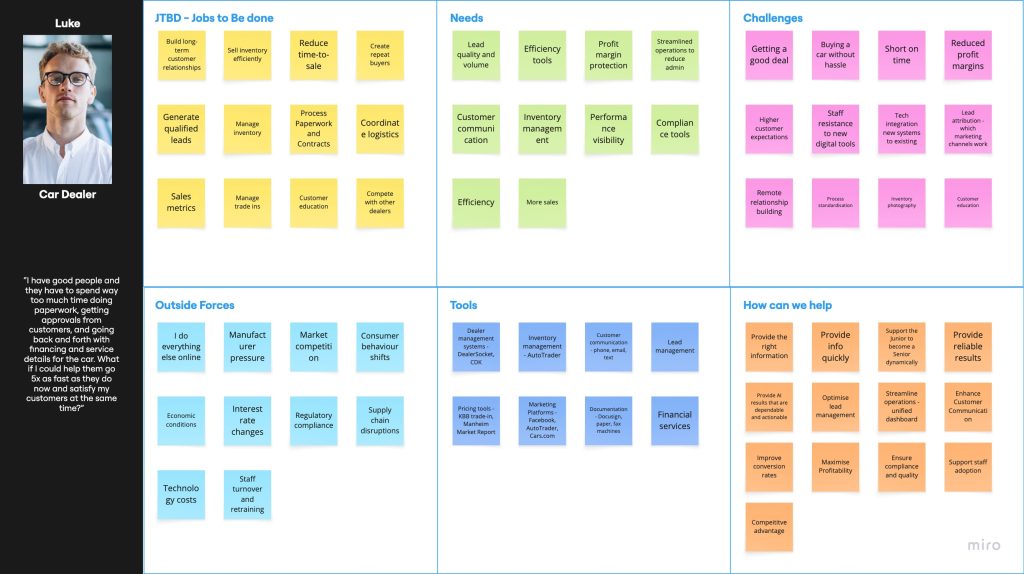

Luke, the Dealer

“I have good people but they spend way too much time doing paperwork, getting approvals from customers, and going back and forth with financing and service details for the car. What if I could help them go 5x as fast as they do now?”

– Luke (Dealer persona)

Luke can manage every aspect of the dealer side of this transaction. He can adjust the financial menu containing his dealership’s lease and loan offerings (communicating with Fern, the Finance Manager to confirm these updates), see sales and inventory stats, and manage his dealerships, all in a paperless mode. Jennifer’s purchase shows on his system as well, and he can check it in a few seconds and approve the deal.

A circle of trust is created between the customer and the dealer, and both get what they want – Luke gets to sell Jennifer a car and the process took 1 hour instead of 5 or 6.

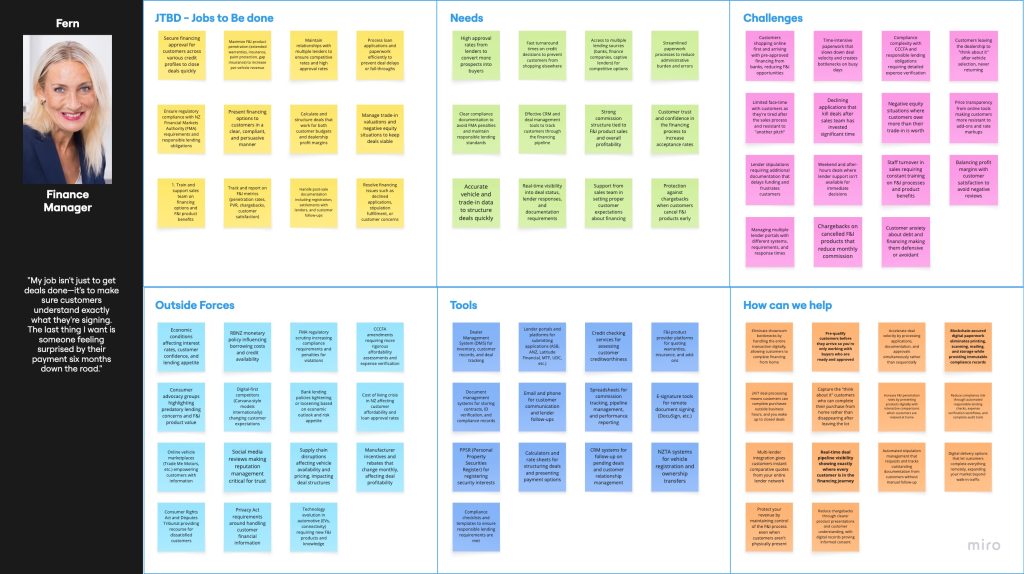

Fern, the Finance Manager

“My job isn’t just to get deals done—it’s to make sure customers understand exactly what they’re signing. The last thing I want is someone feeling surprised by their payment six months down the road.”

– Fern (Finance Manager persona)

Fern is responsible for creating well-blanced finance menu items that help customers buy the car they want at a price they can pay. Since Fern’s job is to bring money into the dealership, she has a vested interest in balancing the needs of the Customer and the Dealer.

AutoBase can then offer the Customer three or four of the best finance menu structures, making it look easy, even though Fern sweats the details in the background!

Outcomes and Lessons

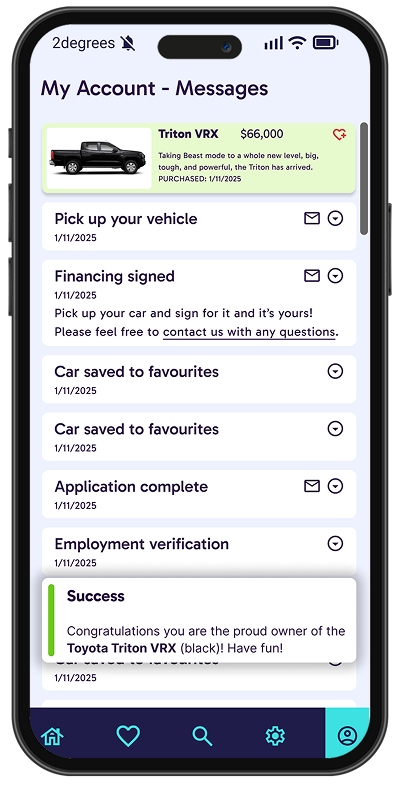

The outcome was a 4th place finish, worldwide, and an app that allowed a customer to buy a car by scanning a QR code, and let a Dealer track and approve that purchase request electronically; even the financing was handled on the Smart Contract (blockchain). We were very excited with the result!

Something we missed was our problem statement and story didn’t explain the role of Smart Contracts clearly enough. The judges couldn’t quite see the value in this app because Smart Contracts were a very new, and risky, concept; where would these public contracts be stored? Would they be fast enough? Would they be secure?

In addition, the event can be stressful with the long hours and tight deadline, and we had some rough patches as a team where we had trouble agreeing on the users, the problem to solve, and our solution. In hindsight we could have used Design Thinking more to go back to the user to focus on Jennifer’s needs, and Luke, how could we serve him more reliably and securely with a publicly available Smart Contract?

We agreed that next time we’d keep the story as simple as possible.

In spite of these difficulties, and pivoting our idea once during the competition, we managed to do extremely well and we learned a lot. The most important thing is the idea and communicating it clearly.

UX Audit Report: AutoBase

Blockchain-Enabled Car Purchase System

Step 1: Research Context

Multi-User Ecosystem

AutoBase serves a three-sided marketplace with distinct but interdependent user needs. The system must coordinate seamlessly between Customer, Dealer, and Finance Manager to achieve the promised 80% time reduction (from 5-6 hours down to 1 hour).

User Profiles

Jennifer, the Customer

- Primary Goal: Purchase a car quickly with full transparency and confidence in the deal

- Pain Points: Traditional process is tedious (5-6 hours), lacks upfront information, creates feelings of being taken advantage of, requires extensive paperwork

- Behaviours: Does independent research, wants mobile-first experience, values speed and transparency

- Key Need: Access to complete information to make informed decisions autonomously

Luke, the Dealer

- Primary Goal: Increase sales volume by reducing transaction friction and paperwork burden on staff

- Pain Points: Staff spend excessive time on paperwork, approvals require back-and-forth, coordination with finance is time-consuming

- Behaviours: Manages multiple dealerships, needs real-time visibility into transactions, wants to empower staff to work 5x faster

- Key Need: Streamlined approval process and paperless transaction management

Fern, the Finance Manager

- Primary Goal: Create balanced finance offerings that help customers whilst bringing revenue to the dealership

- Pain Points: Must ensure customers understand payment obligations to prevent buyer’s remorse, needs to balance customer affordability with dealership profitability

- Behaviours: Creates finance menu structures, sweats the details behind the scenes, focuses on transparency

- Key Need: Efficient communication channel with dealers to update offerings and ensure customer comprehension

Market Context

Whilst the auto industry has various websites and apps for online car purchasing, AutoBase’s differentiator is the blockchain-based Know Your Customer (KYC) documentation that underlies the application. This creates an immutable, trustworthy record of the transaction accessible to all parties, eliminating the need for redundant paperwork and manual verification processes.

Expected Outcomes

- 80% time reduction: From 5-6 hours to 1 hour for complete car purchase

- Paperless transactions: All documentation electronically captured in smart contracts

- Increased sales volumes: Dealers can process more transactions with reduced friction

- Circle of trust: Blockchain verification creates confidence between all parties

- Competitive advantage: 75 million cars sold worldwide annually represents massive market opportunity

Step 2: Design Question

How effectively does the AutoBase system coordinate interactions between Customer (Jennifer), Dealer (Luke), and Finance Manager (Fern) to achieve an 80% reduction in car purchase time through blockchain-enabled KYC documentation and smart contracts?

This question is concrete (evaluating the multi-user coordination system), connected to measurable outcomes (80% time reduction), and framed around the core innovation (blockchain smart contracts replacing traditional paperwork).

Step 3: Reason for Change

The AutoBase system applies Distributed Cognition by leveraging blockchain technology to share transaction state across all three user types simultaneously, eliminating redundant data entry and verification delays. The design uses Tesler’s Law (Law of Conservation of Complexity) by moving the complexity of paperwork, approvals, and financing coordination into the smart contract layer, simplifying the user experience for all parties. By implementing Synchronous Communication Patterns through the QR code scanning mechanism, AutoBase creates a shared mental model where Jennifer’s purchase action immediately triggers Luke’s approval workflow and references Fern’s pre-configured finance options, dramatically reducing the serial handoffs that characterise traditional car buying.

Step 4: Define Terms

| Term | Plain Language Explanation |

|---|---|

| Distributed Cognition | Sharing information and decision-making across multiple people and systems so no single person has to remember or process everything—the system itself holds the knowledge |

| Tesler’s Law (Law of Conservation of Complexity) | Every system has a certain amount of complexity that cannot be reduced—you can only decide who deals with it (users or the system). Good design makes the system handle complexity so users don’t have to |

| Synchronous Communication | Real-time coordination where all parties see updates immediately, like a video call versus email—reduces waiting and miscommunication |

| Smart Contract | Self-executing digital agreements stored on blockchain that automatically enforce terms when conditions are met—like a vending machine that releases your purchase when you insert money |

| KYC (Know Your Customer) | Documentation proving identity and eligibility, stored securely on blockchain so it only needs to be verified once, then trusted by all parties |

| Mental Model | The understanding users have of how a system works—when all users share the same mental model, coordination becomes easier |

| Handoff | When work passes from one person to another (like a relay race)—each handoff adds time and risk of errors |

Step 5: Options Comparison

| Option | Pros | Cons |

|---|---|---|

| Option 1: Traditional In-Person Process | • Familiar to all parties • Face-to-face builds trust • Can address complex scenarios immediately • No technology dependency | • 5-6 hours per transaction • Extensive paperwork for all parties • Serial handoffs create delays • Customer feels pressured and uninformed • Limited sales volume capacity |

| Option 2: Blockchain-Enabled Multi-User System (Preferred) | • 80% time reduction (1 hour total) • Eliminates redundant paperwork • Simultaneous visibility for all parties • QR code creates clear transaction moment • Immutable trust through blockchain • Scales to handle increased volume | • Requires explanation of smart contracts to users • New technology adoption risk • Dependent on infrastructure availability • May feel impersonal to some customers • Complexity if transaction needs modification |

| Option 3: Hybrid Digital-Physical Process | • Maintains some personal interaction • Reduces but doesn’t eliminate paperwork • Easier adoption than full blockchain • Can fall back to traditional methods | • Still requires 3-4 hours • Doesn’t solve core coordination problem • Multiple systems to maintain • Unclear handoffs between digital and physical • Doesn’t leverage blockchain advantages |

| Option 4: Customer-Only Digital Platform | • Empowers customer autonomy • Can research and apply 24/7 • Reduces dealer involvement initially | • Still requires dealer approval handoff • Finance manager coordination unclear • Doesn’t address the 5-6 hour problem • Customer abandoned at crucial decision points • No differentiation from existing auto websites |

Step 6: Detailed Analysis of Each Option

Option 1: Traditional In-Person Process

Implementation: Customer visits dealership, test drives vehicle, fills out paperwork, waits for finance approval, signs multiple documents, completes transaction.

Edge Cases:

- What if financing is declined mid-process? Customer has wasted hours

- What if customer wants to compare multiple dealerships? Process multiplies

- What if dealer needs to contact finance manager who is unavailable? Transaction stalls

Technical Feasibility: Zero effort—this is the status quo.

Risk/Dependency: No technical risk, but high business risk of customer dissatisfaction and limited scalability.

Effort vs Reward: Zero effort, negative reward. Maintains the 5-6 hour problem AutoBase aims to solve.

Option 2: Blockchain-Enabled Multi-User System (Preferred)

Implementation: Three coordinated interfaces:

Jennifer’s Flow:

- Browse cars via mobile app (price, make, model filters)

- Answer financing questions within app

- Receive pre-approved finance options from Fern’s menu

- Select vehicle and financing structure

- Arrive at dealership and scan QR code on vehicle

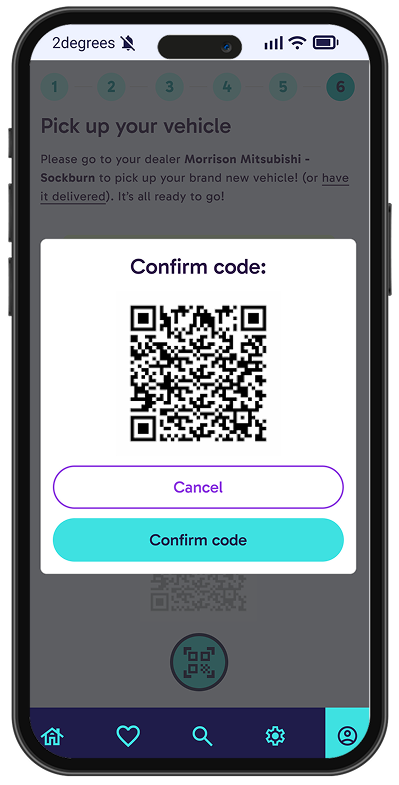

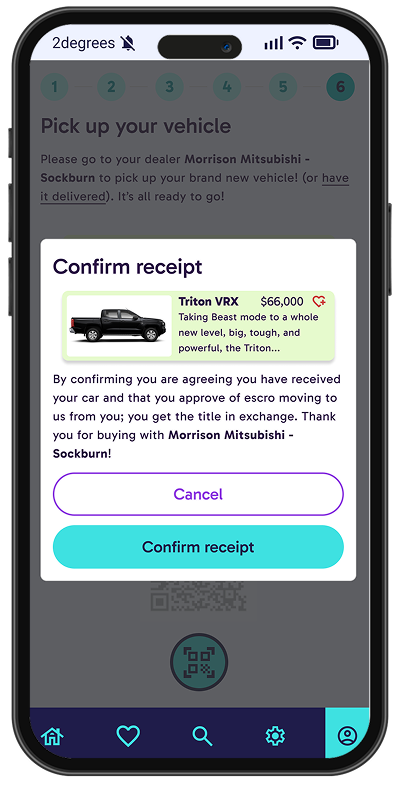

- Complete purchase (blockchain smart contract executes)

Luke’s Flow:

- Configure dealership inventory and pricing in system

- Coordinate with Fern to set finance menu options

- Receive real-time notification of Jennifer’s purchase request

- Review transaction details (seconds, not minutes)

- Approve deal electronically

- Track sales and inventory statistics

Fern’s Flow:

- Create balanced finance menu structures

- Update offerings for Luke’s dealerships

- Monitor which finance options customers select

- Ensure compliance and transparency requirements met

Blockchain Layer:

- KYC documentation stored once, verified by all parties

- Smart contract holds transaction state

- Immutable audit trail of all approvals and changes

- Automatic execution when all conditions met (QR scan triggers final settlement)

Edge Cases:

- Happy Path: Jennifer browses → selects car → gets pre-approved → visits dealership → scans QR → Luke approves → deal closes (1 hour total)

- Unhappy Path: What if Jennifer’s financing falls through after approval? Smart contract should have rollback mechanism or status change capability

- Unhappy Path: What if the QR code doesn’t scan? Need manual override option for Luke

- Unhappy Path: What if Jennifer changes her mind about the finance option mid-process? Need ability to reselect from Fern’s menu

- Coordination Failure: What if Luke is unavailable to approve? Need delegation or auto-approval rules for routine transactions

- System Failure: What if blockchain network is slow or down? Need fallback to traditional process or queue system

- Trust Failure: What if customer doesn’t understand smart contracts? Need clear educational content and optional human support

Technical Feasibility: Medium-high effort—requires:

- Three separate user interfaces with role-based access

- Blockchain smart contract development (Microsoft protocol used)

- Real-time synchronisation between interfaces

- QR code generation and scanning infrastructure

- KYC verification and secure storage

- Finance menu configuration system

- Notification system for approvals

Risk/Dependency:

- Critical Dependency: Blockchain infrastructure must be reliable, fast, and secure (judges’ concern in competition)

- Adoption Risk: All three user types must trust and adopt the system simultaneously

- Regulatory Risk: KYC and smart contracts for vehicle purchases may face legal/compliance hurdles in different jurisdictions

- Education Risk: Users must understand blockchain concepts enough to trust the system

- Network Risk: Public blockchain storage raises questions about speed, security, and permanence

Effort vs Reward: High effort, very high reward. Directly addresses the 5-6 hour problem with measurable 80% time reduction. Scalable solution for 75 million annual global car sales market.

Option 3: Hybrid Digital-Physical Process

Implementation: Customer researches online, dealer uses digital tools for some paperwork, but in-person signatures and approvals still required.

Edge Cases:

- Which parts are digital vs physical? Inconsistent experience

- What if customer completes digital portion but dealer system is down? Process breaks

- How does finance manager coordinate? Unclear handoffs persist

Technical Feasibility: Medium effort—partial digitisation of forms, some integration.

Risk/Dependency: Risk of creating a “worst of both worlds” scenario—complexity of digital systems plus delays of physical process.

Effort vs Reward: Medium effort, low reward. Might reduce time to 3-4 hours but doesn’t achieve the transformative 80% reduction or solve coordination problems.

Option 4: Customer-Only Digital Platform

Implementation: Mobile app or website where Jennifer can browse, configure, and apply for financing—similar to existing auto industry apps.

Edge Cases:

- Jennifer completes application online, then what? Still must visit dealer for approval

- How does Luke see and approve the request? Requires separate dealer portal

- Where does Fern fit in? Finance coordination is unclear

- End result: Digital front-end bolted onto traditional process

Technical Feasibility: Low-medium effort—standard e-commerce patterns.

Risk/Dependency: High risk of creating expectations that aren’t met. Customers may feel misled if they complete online steps but still face 4-5 hours at dealership.

Effort vs Reward: Medium effort, low reward. Doesn’t differentiate from existing auto websites and doesn’t solve the core multi-party coordination problem.

Step 7: Recommendation Summary

I recommend Option 2: The Blockchain-Enabled Multi-User System as the optimal solution. This approach directly applies Distributed Cognition and Tesler’s Law by using smart contracts to handle the complexity of multi-party coordination, KYC verification, and paperwork—freeing all three user types to focus on their core goals. The blockchain layer creates the “circle of trust” mentioned in the research by providing an immutable, synchronised source of truth that Jennifer, Luke, and Fern can all rely on simultaneously. This eliminates the serial handoffs and redundant verification that characterise the traditional 5-6 hour process, enabling the documented 80% time reduction whilst scaling to handle increased transaction volumes.

Additional Considerations for Portfolio Presentation

Strengths of Current Design

- Clear articulation of three distinct user personas with complementary needs

- Workflow map shows thoughtful consideration of interaction points

- QR code scanning provides tangible, physical moment of transaction completion

- Smart contract differentiator is compelling for tech-forward employers

- 4th place finish out of 50 teams worldwide validates the concept

- Honest reflection on lessons learned demonstrates maturity and growth mindset

Opportunities for Enhancement

1. Visualise the Coordination The portfolio shows individual personas well but could strengthen the multi-user coordination story:

- Consider a sequence diagram showing how Jennifer’s action triggers Luke’s notification and references Fern’s finance menu

- Show the blockchain smart contract as the connecting tissue between all three users

- Illustrate the “before and after” of information handoffs (5-6 serial steps vs 1 synchronised blockchain transaction)

2. Address the Judges’ Concerns Proactively You note that judges couldn’t see the value of smart contracts. In the portfolio, consider adding:

- Brief explanation of why blockchain is necessary (immutable trust, no central authority, simultaneous multi-party access)

- Visual showing where smart contracts are stored and how they’re secured

- Comparison: “Traditional process requires 15 paper documents signed by 3 parties. AutoBase requires 1 smart contract verified by blockchain.”

3. Show the Unhappy Paths Given the 48-hour constraint, showing you’ve considered edge cases strengthens the design:

- What happens if Jennifer changes her mind after scanning the QR code?

- How does Luke delegate approvals when he’s managing multiple dealerships?

- What if Fern needs to update the finance menu mid-transaction?

4. Quantify the 80% Reduction Break down where the time savings come from:

- Traditional: 1 hour paperwork + 2 hours financing approval + 2 hours signatures/processing = 5 hours

- AutoBase: 20 min mobile browsing + 5 min QR scan + 35 min dealer verification = 1 hour

- Savings: Blockchain eliminates redundant data entry (45 min), parallel processing of financing (90 min), automatic smart contract execution (90 min)

5. Clarify the QR Code Moment The QR code is a brilliant tangible trigger, but the portfolio could show:

- What information does the QR code contain?

- What happens in the split second after Jennifer scans it?

- How does this trigger Luke’s approval workflow?

- What does Jennifer see on her screen during the 1-second to 30-second wait for Luke’s approval?

6. Show Fern’s Value More Clearly Fern’s role is somewhat passive in the current presentation. Consider showing:

- How Fern’s finance menu structures empower Jennifer’s autonomous decision-making

- The complexity Fern handles (compliance, risk assessment, profitability) that Jennifer never sees

- How Fern’s pre-work during menu configuration enables the 1-hour transaction

Report compiled following the UX Audit Framework by Nathaniel Flick